Payroll outsourcing is gaining traction across Spain. Businesses increasingly streamline operations and cut down on administrative burdens. Many are shifting from traditional payroll processing to outsourcing solutions handled by experts.

This trend isn’t limited to big corporations. Small and mid-sized businesses are recognizing the value of delegating payroll to professionals. They better understand local laws and deliver greater efficiency.

Despite this growing popularity, several hidden benefits of payroll outsourcing remain under the radar. This blog post explores what makes outsourcing payroll such a powerful strategy. Why you might want to rethink your current payroll setup and equip yourself with payroll outsourcing.

Why Payroll Outsourcing is More Than Just a Cost-Cutting Measure in Spain

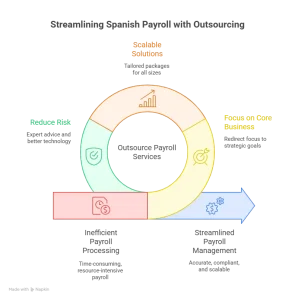

Outsourcing payroll is often seen as a way to reduce expenses. That’s true, the real advantages go much deeper. Spanish businesses gain time, improve accuracy, and boost compliance by utilizing outsourced payroll.

Leading them to enhance the employee experience. Delegating this vital function frees your team from repetitive tasks. It lets you focus on core business goals.

The advantages of outsourcing payroll services go far beyond just cost savings. It comes with reduced risk, better technology, and expert advice, all included in one place.

Focus on Core Business Activities

Payroll processing can consume a surprising amount of internal resources. From calculating salaries to filing taxes, it’s a time-consuming process.

Outsourcing lets your internal team redirect focus from routine admin work to what really matters. You can better grow your business and concentrate on developing client relationships. Giving you ample time to innovate new products or services and support strategic goals.

Instead of worrying about late payments or tax submissions, your leadership team can concentrate on driving revenue.

Stop Struggling with Payroll Complexities in Spain – Let Experts Handle It for You!

Scalable Solutions for All Business Sizes

One common myth is that payroll outsourcing is only for large corporations. The reality? Small and medium-sized enterprises (SMEs) in Spain benefit greatly, often more so than bigger firms.

Outsourced payroll providers offer flexible packages tailored to freelancers and solopreneurs, growing startups, or mid-sized firms with expanding teams.

The good news? You pay only for what you need. It’s up to you to scale services up or down as your team grows or changes. This scalability makes outsourced payroll a smart investment.

Hidden Benefits of Payroll Outsourcing That Spanish Providers Rarely Disclose

Outsourcing payroll brings several lesser-known but powerful benefits. Many Spanish payroll providers don’t market these perks. Yet they make a major difference in everyday business operations. Let’s unwrap a few benefits of payroll outsourcing.

Fixed Costs Become Variable Costs

When you manage payroll in-house, you’re often stuck with fixed overheads: software licenses, training, IT infrastructure, and dedicated staff.

Outsourcing transforms these into variable costs:

| In-House Payroll | Outsourced Payroll |

|---|---|

| Fixed monthly salaries | Pay-as-you-go pricing |

| Annual software updates | Included in service fees |

| IT system maintenance | Managed by the provider |

This shift improves budgeting accuracy and enhances financial flexibility. It is useful for seasonal businesses or those experiencing rapid change.

Access to Payroll Experts Without Hiring

It is costly to hire and payroll professionals. In Spain, staying updated with evolving tax laws and labor regulations requires constant training.

Outsourcing gives you direct access to seasoned experts who understand Spain’s employment laws. These experts monitor legislative changes and provide timely advice.

Their professional capabilities reduce errors and penalties. Get all the expertise without the overheads of hiring full-time staff.

Advanced Security Protocols and Data Privacy

Payroll data includes sensitive and financial information. One mistake could lead to serious legal and reputational risks. Opting for professional help protects you from branches.

These specialists use robust security measures. This includes:

- End-to-end encryption

- Regular cloud backups

- Role-based access controls

- GDPR-compliant data practices

These protocols offer stronger protection than most in-house systems can provide.

Disaster Recovery and Business Continuity

What happens if your internal system crashes? Have you imagined if it gets hacked? Or the payroll manager calls in sick?

Payroll providers have contingency plans that guarantee zero disruptions to payment cycles. They are equipped with regular backups and restore capabilities.

In case of any emergency, don’t worry. You’ll get 24/7 support in emergencies. They prioritize uninterrupted service so your staff gets paid, no matter what.

Expand in Spain without Worrying About Payroll Compliance

Advantages of Payroll Outsourcing Backed by Technology

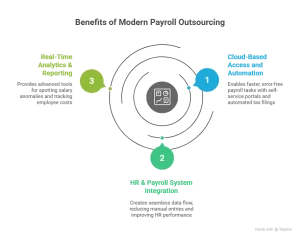

Modern payroll outsourcing is not only about handing off tasks. It’s about using the latest tech to simplify HR operations and support strategic HR functions. Find out some of the advantages of payroll outsourcing.

Cloud-Based Access and Automation

Payroll tasks get done faster and with fewer errors with cloud technology and RPA (Robotic Process Automation).

For instance, there are several benefits of outsourcing your payroll. Providing employee self-service portals to download pay slips or update details.

Have automated tax calculations and filings with real-time status tracking and alerts. Automation achieves accuracy rather than handling them manually. Ultimately, reducing the workload on your HR team helps avoid common HR mistakes that often lead to errors.

HR & Payroll System Integration

Outsourcing providers often integrate payroll with your existing HR systems, creating a seamless data flow:

- Fewer manual entries = fewer mistakes

- Quicker updates for onboarding or offboarding

- Improved overall HR performance

This integration supports better employee lifecycle management.

Real-Time Analytics & Reporting

Good payroll outsourcing firms in Spain offer advanced analytics tools. These help you:

- Spot salary anomalies

- Monitor overtime trends

- Track employee costs per department

You can make smarter, data-driven decisions with custom dashboards and downloadable reports.

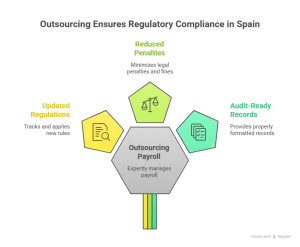

Regulatory Compliance & Risk Mitigation in Spain

Often, Spain’s labour laws and tax regulations change. Staying compliant is tough, especially without a dedicated expert. That’s where outsourcing shines.

Stay Updated with Labour Laws and Tax Rules

Outsourced payroll partners keep your company in the loop. On your behalf, they manage social security updates to equal pay legislation. They:

- Track and apply new regulations

- Adjust payroll calculations accordingly

- Ensure all deductions and contributions are legally compliant

Minimize Legal Penalties and Fines

Payroll mistakes can be costly to businesses. Incorrect filings or late tax payments can cause you many troubles. Resulting in fines, audits, and strained employee trust.

Having an outsourcing firm do file on time, double-check calculations, and provide all necessary legal documentation. This reduces your risk of non-compliance.

Audit-Ready Records

Need to present payroll documents during a tax inspection? Outsourced services provide:

- Properly formatted, ready-to-submit records

- Secure archives for historical payroll data

- Easy access for internal and external audits

This saves you time and stress during critical compliance checks.

Real ROI: What Are the Benefits of Outsourcing Payroll?

The benefits of outsourcing payroll services go beyond time saved:

- Save money by avoiding costly software and internal resources

- Improve employee morale with accurate and timely payslips

- Free up leadership to focus on scaling, not spreadsheets

- Gain peace of mind with compliance, security, and expert support

These returns make payroll outsourcing not just a service, but a strategic investment.

Conclusion

Outsourcing payroll offers visible and hidden benefits to a startup, an expanding mid-sized business, or a larger firm in Spain. Partnering with a payroll provider reduces costs to better compliance and real-time analytics.

The practice is more than just convenience, but it’s a smart business strategy to leverage someone’s expertise. Now is the time to rethink internal processes. Be proactive and consider expert-managed payroll solutions that support your growth.

This article is written to shed insights on how outsourcing payroll is a game-changer for Spanish businesses.

We unwrap the benefits of outsourcing payroll management. Including details that most Spanish payroll firms do not tell you. Hope you find this article valuable.

Need a solution? Why not hire a payroll specialist? Iberia EOR is an evolving payroll outsourcing company with a huge list of satisfied clients. Contact us today and learn how we can help with your payroll processes.

Pay Your Employees on Time, Every Time – without The Hassle

FAQs

What Are the Benefits of Outsourcing Payroll for Small Businesses in Spain?

Outsourcing payroll serves businesses with so many benefits. It saves time and ensures compliance. Gives small businesses access to expert payroll services affordably.

Is Outsourcing Payroll Secure in Terms of Data Protection in Spain?

Yes, outsourcing payroll is safe to use in Spain. Most providers follow GDPR in their payroll processes. They use encryption, backups, and fraud-prevention tools.

How Can Outsourced Payroll Help with Compliance in Spain?

Payroll service providers follow compliance closely. They ensure timely tax filings, legal documentation, and updates in line with Spanish labor laws.