Managing payroll is not just about paying employees. The payroll process also revolves around achieving compliance. It leads you to avoid penalties and helps you to build trust in your workplace.

The payroll processes in Spain carry significant weight. There are many reasons behind it. Some of them are strict labor laws, tax compliance, and others. Employers have the huge responsibility to calculate salaries accurately. They are also expected to deduct taxes and meet reporting deadlines.

Mistakes often happen, and they can harm compliance and employee morale. Several challenges need to be fixed before they turn into a disaster. That’s why a clear roadmap is essential.

Planning to set up a company in Spain? Then, knowing the payroll process is a bonus for you! It will save you time, money, and stress. This step-by-step guide breaks down payroll in Spain in a simple way.

What is the Payroll Process in Spain?

We’ll jump on the payroll process steps later. Before that, let’s define payroll in the Spanish business environment.

Definition:

In Spain, payroll involves calculating gross wages, applying deductions, and issuing net salaries to employees. It also requires maintaining payroll records, preparing payslips, and submitting filings. Accuracy is an important element for compliance and employee satisfaction when setting up a payroll in Spain.

Why Accurate Payroll is Essential for Employers?

Labor law in Spain is strict when it comes to payroll compliance. As per the law, employers must respect their employees’ obligations regarding minimum wage, overtime regulations, and others.

Moreover, the government sets the minimum wage each year. According to this, employers ensure no worker earns below this threshold, regardless of contract type or working hours.

Getting payroll right helps build trust among their employees. Employers can retain talent and protect businesses from fines or disputes, saving them from inaccuracies that can damage their reputation and create legal risks in front of their employees.

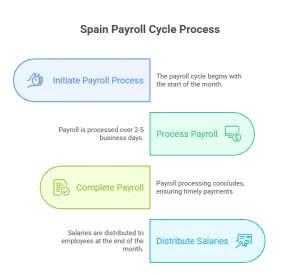

Spain Payroll Cycle Process

In this section, we have discussed the payroll cycle process in Spain. This workflow is a must that employers must adhere to.

Standard Payroll Cycle

Many Spanish companies pay salaries monthly at the end of the month. Spanish labor law doesn’t tolerate payment delays.

Duration of Payroll Process

Processing payroll takes 2–5 business days. The timeline varies, depending on various factors, including payroll system, company size, and internal approval processes.

Payroll Process Flow

Payroll processing in Spain follows many steps. These steps are designed to guarantee compliance and accuracy.

Payroll Preparation

Payroll preparation involves many steps. Starting from, employers collect employee contracts, bank details, NIF/NIE numbers, and social security registrations. A structured payroll preparation process reduces future errors and ensures compliance.

Recording Time and Attendance

In Spain, employers are required to track working hours. Keeping a record of attendance data ensures the correct calculation of overtime, leave, and absenteeism. Also, accurate tracking aligns with laws on working hours in Spain.

Salary Calculation and Deductions

Salaries are calculated by starting with gross pay and subtracting deductions. As an employer, you must apply the current Spain tax rate to calculate net pay accurately.

Spanish employers are responsible for withholding social security contributions from their workers’ salaries, making their own contributions. As of 2025, the employer’s share of contributions is 30.57%. On the other hand, employees contribute 6.48% of their wages to social security.

Payroll Approval Process

Payroll data must be reviewed by HR or management before payments. The payroll approval process prevents disputes caused by common HR mistakes. It can be missed deductions or incorrect benefit classifications.

Salary Payment Distribution

Salary payments are made through bank transfers that may not exceed one month. Employers must meet deadlines as late payments can lead to penalties. According to wage indicator, an employer is obliged to pay 10% interest on late salary payment to their employees.

Payroll Reporting and Record-Keeping

Employers generate payslips and maintain payroll records. The payslips should include total remuneration payable, social security and tax deductions, and employees’ and employers’ information.

Employers are mandated to retain payroll records for a minimum of four years. These are needed for their employees quick audits, tax submission deadlines, filings, and employee transparency.

Post-Payroll Adjustments

After payroll runs for your employees, adjustments for bonuses or error corrections are managed. These steps guarantee employees always receive what they are owed.

Payroll Workflow Process

With each passing year, Spanish employers are now moving from manual payroll processes to automation. It’s a great move that helps businesses reduce manual errors and speed up payroll by adopting an automated model.

Payroll Workflow Process Simplified

A workflow payroll process uses automation rather than a traditional manual process. The automation manages data entry, calculations, and approvals in one system with reporting.

Benefits of Payroll Software in Spain

There are various payroll software benefits that Spanish employers can enjoy. The number one benefit is software automatically updates with changing legislation, as they are designed to align with laws. Secondly, the use of software reduces errors and saves time.

Furthermore, cloud-based systems enhance security and accessibility. Nowadays, many businesses rely on payroll services in Spain. Helping them to streamline processes and maintain compliance.

Payroll Process Checklist

The payroll checklist is a must-have for every employer it saves them a lot of time. We have compiled a monthly checklist, helping employers avoid common mistakes.

- Verify employee contracts and tax IDs to ensure all employee records are up to date.

- Social security contributions should be reviewed each month. Any changes in employee status must be reflected accurately.

- Salaries should only be processed once all internal approvals are completed. This step minimizes errors and achieves accountability.

- Payslips must be accurately generated. It must show salary breakdowns, allowances, deductions, and contributions.

- Tax filings and labor compliance reports must be timely submitted. This keeps your business aligned with labor regulations and prevents penalties.

Following this checklist supports payroll and aligns with broader HR Functions.

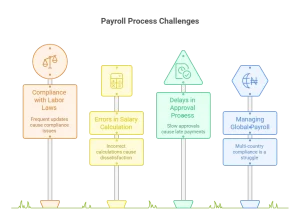

Challenges in the Payroll Process

Processing payroll comes with many challenges. Employers often face difficulties that can derail payroll. However, you can combat these issues by overcoming them.

Compliance with Spanish Labor Laws

The Spanish laws are changing from time to time. Frequent legislative updates make compliance challenging. The key is to stay updated to avoid penalties.

Errors in Salary Calculation

No employee can tolerate wrong salary calculations. Incorrect deductions or benefits lead to employee dissatisfaction. Employers can minimize the risk by leveraging payroll software.

Delays in Payroll Approval Process

The late payments are the root cause that often discourages workers. Slow approvals cause late payments. However, a defined approval chain prevents bottlenecks.

Managing Payroll for International Employees

Global companies often struggle with multi-country compliance. The benefits of payroll outsourcing include simplified processes and legal accuracy.

Tips for Smooth Payroll Management in Spain

Managing payroll efficiently is not that complicated. Employers can adopt proven strategies for a smooth execution.

Create Transparent Payroll Policies

When you have transparent policies in place, your employees understand payment schedules and deductions.

Integrate HR and Payroll Systems

It can be fruitful if you integrate payroll with HR Services. This step reduces duplicate data entry and errors.

Stay Updated with Spanish Tax and Labor Laws

Mostly, it’s hard to comply with strict Spanish tax and labor laws. That’s why regular monitoring is needed, ensuring ongoing compliance.

Outsource Payroll to EOR or Service Providers

Finding it difficult to manage your payroll? Why not work with EOR service providers in Spain? This will ease the complexity of payroll management.

Wrapping Up!

In Spain, payroll is a structured process. The process directly impacts compliance and employee satisfaction. Employers can avoid errors and strengthen trust by following each step, from preparation and calculation to approvals and adjustments.

Refining your payroll workflow saves time and reduces risk. New to the Spain business market? You can rely on Iberia EOR and get their expert support in payroll, HR, and compliance. Let everything be managed by specialists.

FAQs on Payroll Process in Spain

What Is The Payroll Process in Spain?

The payroll process involves calculating gross pay, applying tax and social security deductions, and paying employees their net salary on a monthly basis.

How to Process Payroll For The First Time in Spain?

You can start by registering employees with Social Security, collecting tax IDs, setting up contracts, and using payroll software or outsourcing providers.

How Long Does Payroll Take to Process Each Month?

Each month, payroll takes about 2–5 business days, depending on approvals and payment systems.

What Are The Key Steps in The Payroll Process Flow?

The payroll process follows a series of steps like preparation, time tracking, calculation, approvals, payments, reporting, and adjustments.

Do I Need to Provide Payslips to Employees in Spain?

Yes, Spanish employers must issue detailed payslips with each payment.

Can I Outsource the Payroll Process to A Provider in Spain?

Yes, many employers outsource payroll to ensure accuracy, save time, and maintain compliance.