Are you expanding your business into Spain? Then you are not alone in feeling a bit overwhelmed. Spain is a powerhouse market with thriving industries, skilled talent, and attractive business incentives.

Many global companies are eyeing the market here. But they keep getting bogged down by complex employment laws, bureaucratic processes, and the constant fear of missteps in compliance.

That’s where an employer of record steps in to save the day. Instead of setting up a local entity in Spain, you can access the Spanish talent pool legally and efficiently without losing time or making costly mistakes. An EOR gives you speed, scale, and compliance, all in one neat package.

What is an Employer of Record (EOR)?

An Employer of Record is a third-party service provider that legally employs workers on behalf of a foreign company. While you manage the day-to-day work and team responsibilities, the EOR handles everything from contracts and payroll to taxes, and employee perks on your behalf.

This service model gives businesses access to local labor markets without setting up a legal entity. The EOR becomes the legal employer in Spain, taking care of all country-specific employer obligations. In turn, this ensures that your company can focus on operations, not compliance.

Our EOR in Spain Means You Hire Legally Without an Entity

Spanish EOR Explained Simply

The Spanish EOR model is built around one most important factor: strict local labor laws.

Strong worker protections, detailed collective bargaining agreements, and a pretty well defined tax structure are among some of the things that Spain upholds. Now what an EOR does is take on all these responsibilities, so you do not have to.

They make sure all your employees are getting their due rights, the tax deductions are being made correctly, and that none of your business processes are violating government standards. And yes, that includes your taxes in Spain, too.

Spain is quite serious about its labour compliance. A single misstep could result in heavy fines or even your business’ reputation taking a huge hit.

That’s why companies run a higher risk of inviting fines, lawsuits, or facing costly delays in launching their operations, when they are lacking an EOR’s local insights.

An employer of record truly understands the national standards as well as the regional nuances. As they operate with this knowledge, applying it where necessary, they ensure you remain compliant with the local labor laws.

They register employees with social security, make proper tax withholdings, guarantee adherence to collective bargaining agreements that can vary across industries, and work well with other local nuances, including:

- The 14-month salary structure

- Statutory severance payments

- Strict notice period enforcement

- Paid holidays and regional festivals

This reduces your liability while building your brand trust with the local talent. EORs also make sure you are meeting the regulations for taxes in Spain, including income tax brackets, employer contributions, and any sector-specific deductions. Without their expertise, even a well-intended hiring strategy could trigger tax audits or penalties.

What Does an Employer of Record Do in Spain?

An EOR in Spain functions as the official employer on paper. But it lets you call the shots operationally. These are all the things they manage on your behalf:

- Drafting and signing legally compliant contracts

- Registering employees with local authorities

- Running payroll with accurate deductions

- Administering benefits and leave entitlements

- Staying updated with labor law changes

- Handling disciplinary actions and terminations legally

- Providing tax documentation and audit readiness

- Ensuring secure handling of personal data under GDPR

The EOR works in the background, and you can fully focus on performance, customer experience, and building your brand.

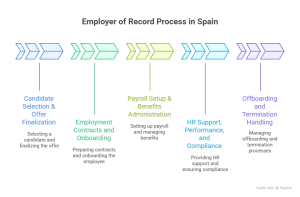

A Step-by-Step Employer of Record Process in Spain

In this section, we will explain the employer of record process in Spain, starting from hiring all the way to offboarding.

Following this roadmap means you will be in full legal compliance and experience smooth employee management for foreign companies.

Step 1: Candidate Selection & Offer Finalization

The first step in the process involves you selecting the candidate. You define their role and determine their compensation. Then the EOR will formalize their offer as per Spain’s regulations.

Pre-employment checks, reviewing candidate’s eligibility to work in Spain, and evaluating their salary against the market norms are included in this step.

Step 2: Employment Contracts and Onboarding

Now that the offer has been accepted, it’s time to move on to the next step. The EOR will prepare a contract compliant with local laws.

Employee onboarding will include collecting all the necessary employee onboarding documents, verifying the tax details, and registering the social security for your employee. All the paperwork is archived the way Spain’s data protection regulations demand.

You May Also Like: EOR Contract

Step 3: Payroll Setup & Benefits Administration

Your EOR will then set up the payroll, apply all the right tax rates, and ensure payment of statutory benefits. They will also be the one in charge of handling paid holidays and healthcare contributions among other essentials.

Payslips are issued monthly. Your EOR will also make sure you are in compliance with the 14 month salary payment model, pension fund coordination, reimbursements or allowance processing, and taxes in Spain.

Step 4: HR Support, Performance, and Compliance

EOR’s services go way beyond onboarding. They offer ongoing HR services in Spain too. This helps companies, like yours, with their policy updates, training coordination, performance reviews, and labor compliance.

Other than that, they also conduct pulse surveys, implement disciplinary procedures whenever needed, and handle dispute resolution for you with legal backing. These are among the key HR functions, and their regular audits and documentation updates ensure you keep up with any regulatory changes.

You Can Also Check Out: Human Resource Mistakes

Step 5: Offboarding and Termination Handling

When your employee part ways or the employment comes to an end, the EOR makes sure all the notice periods are properly followed, severance is correctly calculated, and all the exit paperwork is filed in a way that would avoid any legal hiccups in the future.

They will also handle final pay settlements, deregistration from social security, and the collection of all company assets from the employee. Terminations are documented in a way that protects both employer and employee.

From Contracts to Compliance – Our Spain EOR Covers It All

EOR Onboarding Checklist in Spain

A thorough onboarding guarantees compliance from the very beginning. We have a checklist here that’s often followed by Spanish EORs to integrate new hires smoothly.

Documents Collected During Onboarding

- Valid national ID or passport

- Spanish social security number

- Bank account details

- Tax identification number

- Proof of address

- Emergency contact details

- Academic certificates

- Previous employment history

Employment Contract Inclusions

- Job title and responsibilities

- Working hours and location

- Salary and bonus structure

- Vacation and sick leave policies

- Applicable CBA clauses

- Benefits coverage

- Non-compete clauses or confidentiality agreements

When onboarding through EOR services, this checklist indicates a fully compliant and clear employment setup.

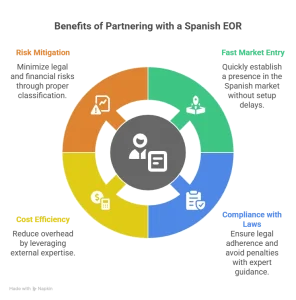

Key Advantages of Working with a Spanish EOR

Are slow hiring, high overheads, or legal risks giving you major troubles for your business? Partner with an EOR to easily solve all these pain points. These are some of the EOR benefits that matter:

Fast Market Entry

Choose your candidate and enter the market without facing any entity setup delays. Companies can test their market feasibility, run pilot projects, or launch their temporary campaigns with a full team within weeks, all thanks to the EOR model.

Compliance with Spanish Labor Laws

You stay legally compliant as EORs operate within employment protections and tax rules. They monitor law changes and ensure contracts, policies, and operations reflect the labour laws.

Cost & Resource Efficiency

Get services backed by compliance specialists and local payroll experts. You don’t have to hire internal teams. Because EORs provide you with local support and expertise without that extra overhead.

Risk Mitigation & Employee Classification

Correctly classify workers and avoid any legal issues or fines. With EORs, you reduce that risk and stay audit-ready.

Feel empowered in entering new markets without getting sidetracked with legal issues, compliance matters, and violations of regulations.

You May Also Like: Employee Relocation Process

How Companies Use EOR to Scale Operations in Spain

Companies across various industries, from tech startups to manufacturing plants, use EORs to scale their teams, test new markets, or quickly onboard their contract talent.

Temporary Projects & Short-Term Hiring

Is your company considering options for entering the Spanish market without full commitment? EORs are ideal for that! They are also the preferred choice for seasonal work, consulting contracts, product testing phases, or field research.

Long Term Expansion Without Entity Setup

Do you want to build a permanent team here in Spain without having to wait months for an entity registration? Then, an employer of record is the best solution for you. With them, you get the flexibility of hiring your local staff while expanding globally.

Local Talent Acquisition & Retention

Are you perhaps eyeing competitive hubs, namely Barcelona, Madrid, and Valencia, to recruit talent? EORs help you identify, onboard, and retain skilled workers. Many EORs will also offer you recruitment support, salary benchmarking, and ongoing employee engagement strategies.

Understanding the EOR Employment Model in Spain

The EOR model in Spain is a tripartite structure, with:

- Client Company

- EOR Provider

- Employee

Here’s how this tripartite relationship works:

- The client company directs the employee’s daily work

- Their EOR Provider becomes the legal employer managing compliance and payroll

- The employee is legally employed by the EOR and operationally guided by the client

What this model does is combine flexibility with legal assurance. You control your workforce. Meanwhile, your EOR handles everything behind the scene, including payroll and taxes. You also get the benefits of payroll outsourcing out of this arrangement.

Choosing an employer of record is a scalable solution too. You can easily start with one hire and eventually grow to a full team with minimal administrative load.

Spanish Labor Laws: Why You Need an EOR

Spain’s labour system is detailed. It also centers around its workers. You are looking at:

- Binding CBAs

- 14-month salary structure

- Strict notice periods

- Mandatory severance pay

- Paid public holidays

- Occupational health and safety mandates

Trying to figure out all the Spain labour laws on your own without local expertise is going to be a guessing game. One that has the highest chance of you losing. That’s why having an EOR is better, as they make compliance completely possible.

Choosing the Right Employer of Record in Spain

Not all EORs are the same. We have a list here to assist you in knowing what you should look for in one:

- A strong in-country presence

- Experience with your sector

- Transparent pricing models

- Knowledge of both national and regional labor laws

- Tech-driven platforms for payroll and HR

- Clear Service-Level Agreements (SLAs)

These factors will ensure smoother onboarding and long-term success.

Final Thoughts: Simplify Your Hiring in Spain

Hiring in Spain doesn’t have to be confusing. With the right EOR, it’s faster, safer, and fully scalable.

Are you ready for your business’ global expansion? Partner with Iberia EOR for our expert-backed EOR services in Spain and smooth expansion. Gain access to top Spanish talent, reduce legal risk, and get your team running in weeks instead of months.

With Our EOR in Spain, You Focus on Growth – We Handle the Rest

FAQs

Is Using an EOR Legal in Spain?

Yes, it’s fully legal and widely used by international companies operating in Spain.

How Long Does the EOR Onboarding Process in Spain Take?

The EOR onboarding process in Spain takes between 1 to 2 weeks, and can be even faster if all documents are ready.

Will I Still Manage My Employees if I Hire Through an EOR?

Absolutely. You direct their daily tasks while the EOR handles backend compliance.

What Industries Benefit the Most from Using an EOR in Spain?

Tech, digital services, manufacturing, consulting, life sciences, eCommerce, and any fast-scaling sector needing quick and compliant hiring.