Hiring a new employee should be exciting-but for many businesses, it quickly turns stressful. Missing paperwork, unclear onboarding requirements, or compliance gaps can create costly delays. Worse, overlooking essential documentation can expose you to legal risks, payroll errors, or even fraudulent hires.

That’s where a comprehensive employee documents checklist comes in. With the right structure in place, you’ll know exactly which documents are required for hiring an employee, from recruitment all the way to exit, ensuring a smooth and compliant process every time.

This guide walks you through every stage-recruitment, onboarding, employment, payroll, and termination-while highlighting best practices and risk prevention. By the end, you’ll have a ready-to-use framework for managing employee documents efficiently.

What Is an Employee Documents Checklist?

An employee documents checklist is a structured list of all the paperwork HR needs to collect, verify, and maintain throughout the employee lifecycle.

Think of it as a roadmap:

- It helps ensure compliance with labor laws.

- It prevents oversights that could disrupt your hiring process.

- It creates a transparent record of an employee’s journey, from hiring to exit.

Whether it’s employee verification documents, tax forms, or performance records, this checklist keeps everything organized and accessible.

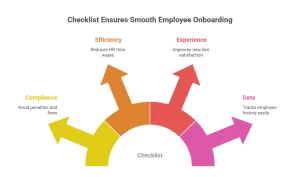

Why Having a Checklist Is Crucial for Employers

Skipping or mismanaging documentation isn’t just inconvenient-it’s risky. Employers who don’t follow a proper employee onboarding documents process often face:

- Compliance penalties: Missing proof of eligibility or tax forms can trigger fines during audits.

- Hiring delays: Without a structured checklist, HR teams waste time chasing documents.

- Poor employee experience: Disorganized onboarding leaves new hires frustrated.

- Data gaps: Missing records make it hard to track promotions, benefits, or payroll history.

In short, the documents required for a new employee aren’t just paperwork-they’re the foundation of legal compliance, efficiency, and employee trust. For businesses focused on growth or setting up a company in new markets, getting this right is non-negotiable.

Employee Documents Checklist: From Recruitment to Exit

Hiring is just the beginning. Employers need to manage documentation throughout an employee’s lifecycle. Below is a stage-by-stage checklist of the new employee documents you’ll need.

1. Recruitment & Hiring Documents

During recruitment, documentation ensures that the candidate is legitimate and the offer process is clear.

- Job application, CV, and cover letter – Proof of the candidate’s background and skills.

- Employee verification documents – Identity proof, address proof, educational certificates, and reference checks to confirm authenticity.

- Background check results – Criminal, credit, and previous employment checks.

- Job description & offer letter – Clearly outline responsibilities, expectations, and compensation.

- Signed acceptance of offer – Confirms terms agreed upon.

Why it matters: Missing verification can lead to fraudulent hires, which is one of the most overlooked yet costly issues for businesses.

2. Employee Onboarding Documents

Once a candidate accepts the job, onboarding documentation ensures a legally binding, transparent start.

- Signed employment contract or EOR contract – Defines employment terms, job role, salary, and benefits. For global hiring, this often falls under an EOR model.

- Non-disclosure & confidentiality agreements – Protects company data.

- Employee handbook acknowledgment – Confirms the employee has read company policies.

- Emergency contact form – Vital for workplace safety.

- Tax forms & payroll setup documents – Ensures accurate salary, benefits, and deductions.

Why it matters: A missing payroll setup can cause salary errors, damaging trust from day one. For businesses using HR services or outsourcing models, having these forms ready avoids delays.

3. Employment & Compliance Documents

During employment, companies must maintain updated records for compliance and reference.

- Work eligibility proofs – Visa, residency permits, or work authorizations (essential for international employees).

- Certificate of employment history – Proof of prior roles when needed.

- Qualification certificates & licenses – Industry-specific roles often require updated licenses.

- Salary structure & benefits enrollment forms – Breakdown of pay, allowances, and insurance.

Why it matters: If audited, missing compliance documents can lead to penalties or even license suspensions for the company.

4. Performance & Development Documents

Beyond compliance, companies need to track employee growth and productivity.

- Training records & certifications – To prove skill upgrades.

- Performance appraisals – Annual or quarterly reviews.

- Promotion or transfer letters – Track career progression.

- Disciplinary records – Maintain transparency for any disputes.

Why it matters: Performance documentation helps in promotion decisions and protects employers during disputes over appraisals or role changes.

5. Payroll & Leave Records

Smooth payroll management depends on accurate, updated records.

- Salary slips & tax documents – Proof of payments and deductions.

- Leave applications & approvals – Record of holidays, sick leave, and unpaid leave.

- Attendance records – Helps in payroll calculations.

Why it matters: Errors in payroll not only hurt employee morale but can also trigger compliance issues with tax authorities.

6. Exit & Termination Documents

When an employee leaves, documentation ensures closure without disputes.

- Resignation or termination letter – Official notice of exit.

- Exit interview records – Capture feedback and insights.

- Full & final settlement papers – Salary dues, bonuses, and reimbursements.

- Company property return checklist – Laptops, ID cards, and other assets.

- End-of-employment certificate – Often requested for new job applications.

Why it matters: Incomplete exit documents can cause payroll disputes, asset loss, or even legal action.

Best Practices for Managing Employee Documents

Collecting files is only half the battle-managing them securely and systematically is the real challenge.

- Use a standardized filing system – Create templates for every employee.

- Separate active vs. inactive files – Avoid clutter and confusion.

- Digitize wherever possible – HR software makes retrieval faster and more secure.

- Update regularly – Licenses, certificates, and tax details expire.

- Maintain confidentiality – Sensitive data should only be accessible to authorized personnel.

For businesses scaling globally, partnering with experts can ease the burden.

Also Recommended: Tie Card in Spain

How a Proper Checklist Prevents HR Risks

A structured employee documents checklist isn’t just about being organized-it’s about risk prevention.

- Avoids legal penalties – Compliance audits become stress-free.

- Prevents payroll delays – Correct tax and salary documents ensure timely payments.

- Improves hiring credibility – Proper verification builds trust with new employees.

- Boosts retention – Organized onboarding makes employees feel valued.

Pro tip: Many businesses fail not because they hire the wrong people, but because of missing paperwork-a costly yet avoidable common HR mistakes.

Conclusion

Managing employee documents isn’t optional – it’s the backbone of a legally compliant, efficient, and employee-friendly workplace. From recruitment paperwork to exit checklists, every document plays a role in reducing risks and creating a smooth employee experience.

If your business is expanding to Spain, Iberia EOR can help streamline operations, ensuring compliance-ready documentation and hassle-free onboarding.

FAQs

1. What Documents Are Required for Hiring an Employee?

Typically, ID proof, address proof, educational certificates, work eligibility documents, and an offer letter are required.

2. What Is Included in Employee Onboarding Documents?

An employment contract, tax forms, payroll setup, handbook acknowledgment, and emergency contact forms.

3. How Long Should Employee Documents Be Kept After Termination?

Most documents must be retained for 3-7 years, depending on local laws. Payroll and tax documents may need longer storage.

4. What Are Employee Verification Documents and Why Are They Important?

These include IDs, previous employment proofs, and background checks. They prevent fraudulent hires and ensure compliance.

5. Can HR Use Digital Files Instead of Paper Records?

Yes. Many companies now use secure HR software for faster, safer document storage.

6. What Is the Difference Between Employee Documents and A Certificate of Employment?

Employee documents cover all records across the employee lifecycle, while a certificate of employment is usually issued upon request or termination as proof of work history.