Are you growing fast, and juggling payroll and local laws feels like spinning plates blindfolded? You’re not alone! Over 60% of businesses expanding globally report challenges in managing payroll, benefits, and compliance.

The big question hits you: Should you go with an EOR or an AOR? Before making a decision, knowing the difference is essential, as having no knowledge can cost you in risk or overpaying for services you don’t need.

At the end of this post, you’ll grasp the difference between EOR vs AOR. We’ll deep dive into the Employer of Record vs Agent of Record debate while unwrapping which model fits your business desires without drowning in legal talk.

What are EOR and AOR?

In this section, we’ll talk in detail about what EOR and AOR are, so keep reading to find out their meanings. You need to understand what these terms actually mean and why they matter to your international hiring strategy before diving into decision mode.

What is an Employer of Record (EOR)?

For your global hire, the EOR model lets a third-party become the legal employer. It is perfect when you have no local entity. They handle payroll, tax withholding, benefits, employment contracts, and labor law compliance.

Still, you manage day-to-day work, but the EOR carries the legal weight. In short, EOR lets companies hire without setting up a local entity.

What is an Agent of Record (AOR)?

The (AOR) Agent of Record acts as an intermediary when you’re dealing with independent contractors. They manage classification checks, compliant contracts, payment facilitation, and audit-ready documentation, but you remain the actual employer.

This model is best suited for businesses relying on contractors or project-based teams where flexibility matters more than long-term employment.

Key Differences Between EOR and AOR:

The section covers the key differences between the two. We are going to discuss how EOR and AOR contrast in what they do, their costs, liability, and value.

| Feature | Employer of Record (EOR) | Agent of Record (AOR) |

|---|---|---|

| Legal Status | Becomes the legal employer of your global hires. | Acts only as an administrative intermediary; you remain the legal employer. |

| Cost Structure | Typically $199–$650 per employee per month or 10–20% of salary depending on provider and country. | Usually a flat fee per contractor; lower overall cost. |

| Ideal Use Case | Hiring full-time employees in a country where you don’t have a local entity. | Managing independent contractors or freelancers under an existing local entity. |

| Risk & Compliance | Assumes responsibility for taxes, payroll, benefits, and labor law compliance, minimizing misclassification risks. | Provides classification support and contract management, but legal liability stays with you. |

| Payroll Responsibility | Handles full payroll processing, tax withholding, benefits deductions, and remittances. | Facilitates payments and invoices only; you manage tax filings. |

5 Questions to Ask Before Choosing EOR or AOR

Making the right choice between an Employer of Record (EOR) and an Agent of Record (AOR) depends on your company’s current setup, risk appetite, and growth goals. Use these five key questions to narrow your decision:

- Do You Have a Legal Entity in the Target Country?

- If no, an EOR is usually the best fit since it acts as the legal employer.

- If yes, AOR can help manage contractors without duplicating infrastructure.

- Are You Hiring Employees or Independent Contractors?

- Hiring full-time employees typically requires an EOR.

- Managing freelancers or project-based contractors leans toward AOR.

- How Much Compliance Risk Are You Willing to Carry?

- EOR assumes payroll, tax, and labor law responsibility.

- AOR supports compliance but leaves the legal risk with your company.

- What Is Your Budget for Global Hiring?

- EOR packages are more expensive but include full HR, payroll, and legal services.

- AOR offers lower costs if you already have internal HR and payroll systems.

- How Quickly Do You Need to Enter the Market?

- EOR allows immediate hiring without entity setup.

- AOR requires that you already have systems in place and can afford a slower setup.

Cost Comparison: EOR vs AOR Pricing

| Service Model | Typical Cost Range | Pricing Basis | What’s Included |

|---|---|---|---|

| Employer of Record (EOR) | $199 – $650 per employee per month or 10–20% of employee salary | Per employee, per month or salary percentage | Payroll processing, tax withholding, statutory benefits, employment contracts, HR administration, compliance management |

| Agent of Record (AOR) | $25 – $100 per contractor per month (flat fee) | Per contractor, per month | Contractor classification, contract management, payment facilitation, audit-ready documentation |

Factors That Influence Pricing

Several variables can affect where your costs fall within these ranges:

- Country of Employment: Nations with complex labor laws (e.g., Spain, Germany) tend to have higher compliance and payroll costs.

- Employee Salary Levels: EOR providers that charge a percentage of salary will increase in cost as employee compensation rises.

- Scope of Services: Full-service packages (including benefits administration, tax filings, and HR support) cost more than basic payroll-only plans.

- Team Size: Volume discounts may apply for larger teams; smaller teams typically pay higher per-person fees.

- Contractor Complexity: For AOR, costs can increase if contractors are spread across multiple countries or require complex classification checks.

When to Choose EOR Over AOR:

In this section, we walk you through some scenarios where EOR fits best. It helps you to free yourself from overpaying. Let’s find out what those scenarios are.

Expanding to New Markets Quickly:

Employer of Record works for you when you don’t have a local entity. Under EOR, you onboard teams across borders in days, not months, renting compliance infrastructure rather than building it.

Minimizing Legal Risks and Compliance Burdens:

Having an Employer of Record shields you in the difficult times. They stay on top of regulations. Their presence reduces misclassification, tax exposure, and fines.

In other words, EOR lets you experience a strong suite of employer of record benefits that offer legal guardrails without infrastructure headaches.

Managing Remote or International Teams:

If your business needs global engineers, marketers, or remote teams quickly, then you should opt for EOR. They centralize payroll, benefits, and contracts across geographies.

In this way, you have more time to stay focused on your business outcomes, not HR logistics that are often time-consuming.

In short, EOR is your go-to when speed, compliance, and global team management matter most

When to Choose AOR Over EOR:

If you already have an established business with a fully maintained structure, then you can add on AOR to save you money by outsourcing some of your tasks.

Existing Local Entity:

Companies that exist legally in-country must have payroll systems in place. This way, you can get help from the Agent of Record with contractor compliance, not full legal employment.

Remember that AOR supports you in achieving flexibility without duplicating the infrastructure you already maintain.

Focused Insurance and Administrative Support:

If you need help managing contractor insurance, benefits, or onboarding, then you should go for Agent of Record. They handle classification, contracting, and payments for you.

However, they don’t take care of payroll or taxes; you need to manage them yourself. In short, when you just want admin efficiency for freelancers, AOR does the job for your business.

Cost-Efficiency for Established Businesses:

For already running businesses, AOR costs less than EOR because the scope is narrower. If your in-house HR or finance teams handle payroll and taxes, then outsourcing contractor compliance through Agent of Record offers clean cost efficiency.

In short, AOR is the smart choice if you already have a local footprint and just want streamlined contractor management.

Deciding Between EOR and AOR:

Making a smart decision is essential as it’s a matter of your business. We’ll share a simple action plan to help you decide smartly without banging your head against the wall.

Assess Your Legal Presence:

The first step is to assess whether you have a legal presence or not. You may select Employer of Record if you’re setting up a company for hiring purposes without thinking much.

However, AOR works well for you if you already have a local setup. You should understand that having an entity leads you to achieve more flexibility, and as a result, AOR is your go-to partner. On the other hand, if you have no entity, then EOR is the solution for you.

Evaluate Compliance and Risk Needs:

Does your business need full protection from tax, labor law, and payroll risk? Go for an Employer of Record. But, if it requires classification plus admin support, then your answer is Agent of Record.

Compare Costs vs Benefits:

At this point, you need to list your payroll, HR, and admin costs. It has been experienced and seen that EOR packages may feel pricier. However, it factors in entity setup, legal fees, and compliance training. On the other hand, if you hire an AOR, then you’ll be charged less than an EOR.

Consider Employee Experience:

This one is the most important factor you need to consider. Every employee wants seamless onboarding. Not only this, but they need their pay and benefits to be timely and fast.

Also, the probation period matters as well. In that way, EOR delivers a better experience. However, AOR works if you’re ready to manage those internally.

In short, your decision boils down to whether you need a legal employer (EOR) or a contractor compliance partner (AOR).

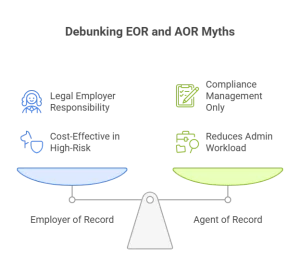

What are the Common Misconceptions About EOR and AOR?

In this section, we’ll discuss some of the common myths about EOR and AOR. Believe us, there are only myths, far from reality. You can have an idea about them by reading this section. Let’s bust myths you might still hear!

Misconception 1: EOR and AOR Are the Same

According to the first misconception, AOR and EOR are the same, but they are not. Your Employer Of Record becomes the legal employer and handles payroll, benefits, contracts, and compliance. On the other hand, your Agent of Record manages compliance and admin only for contractors.

Misconception 2: AOR Handles All Compliance

Another misconception, which is actually not true, is that the Agent of Record handles all compliance for you. However, your AOR reduces admin work but doesn’t remove legal responsibility. Misclassification claims still fall to your business. So you still need internal oversight.

Misconception 3: EOR Is Too Expensive for SMEs

For small businesses, it is not always the case that EOR seems costly. In many cases, especially high-risk scenarios/new markets, EOR saves legal fees, setup costs, and compliance risks.

Therefore, it depends case to case. Sometimes, it’s more cost-effective in the long term when growth amplifies complexity. In short, knowing these differences helps you avoid costly mistakes when choosing between EOR and AOR.

Final Words:

The breakdown of the difference between EOR and AOR helps you understand well what each model offers, and when to choose which. We summed up both models in a simple way: like EOR gives you legal employment, payroll, benefits, and compliance.

The model is handy for launching in new markets. On the other hand, AOR keeps contractors compliant and paperwork tidy. The model is ideal when you have systems in place.

Now, the decision is yours. Look at your current setup and ask: Do you need full legal support, or just administrative backup? Align with your needs, and choose wisely.

For instance, Iberia EOR stands out for managing complex cross-border hires effortlessly. You can explore our employer of record services that fit your pace and protect your business. If you need any help regarding our services, send us a message.

FAQs:

What Is the Main Difference Between EOR and AOR?

Employer Of Record becomes the legal employer, handling payroll, benefits, taxes, and compliance. On the other hand, Agent of Record manages contractor admin, including classification, contracts, and payments, while you remain the official employer.

Can a Company Use Both EOR and AOR at The Same Time?

Absolutely! Many businesses use AOR for flexible contractors and EOR for full-time international employees. Employers use this hybrid model to achieve compliance, flexibility, and efficiency.

Which Is More Cost-Effective: EOR or AOR?

It has been seen that AOR costs less due to a limited scope, while EOR costs more but saves you from setting up entities, legal fees, and compliance headaches. Still, the right choice depends on the entity’s presence and who handles what.

Does EOR Handle Employee Benefits Globally?

An Employer Of Record administers local statutory and supplementary benefits like healthcare, pension, paid leave, and compliant contracts.

Is AOR Responsible for Tax Compliance?

The agent of record helps in correcting classification and payment flows. However, tax and legal compliance remain your responsibility. You must understand that AOR’s role is to support you; it doesn’t replace your oversight.

How Do I Decide Whether to Hire EOR or AOR?

The decision can be made by checking your legal presence. EOR fits well if you’re entering new markets without an entity. However, if you’re managing contractors under an existing structure, AOR may work. Remember that you should always balance cost, risk, and speed of setup.